Low-Cost Non-Dilutive Capital

Mezzanine-Type Leverage at the Cost of Senior Debt from a Partner Who Behaves Like Preferred Equity

A Sale-to-Service is the Sale-Leaseback for the Modern Economy

Intangible Assets

The U.S. has moved from an industrial economy reliant on physical assets like equipment and real estate to a service economy reliant on intangible assets, assets often described as a company’s know-how or intellectual property.

Sale-to-Service

Leeward’s patent-pending Sale-to-Service® structure, which is similar to a sale-leaseback or operating lease of physical assets, monetizes server-based intangible assets, also described as mission-critical systems and data.

Value Proposition

A Sale-to-Service® delivers a low-cost covenant-free alternative to mezzanine debt and minority equity for liquidity events, management and shareholder buyouts, family ownership transitions, and acquisitions.

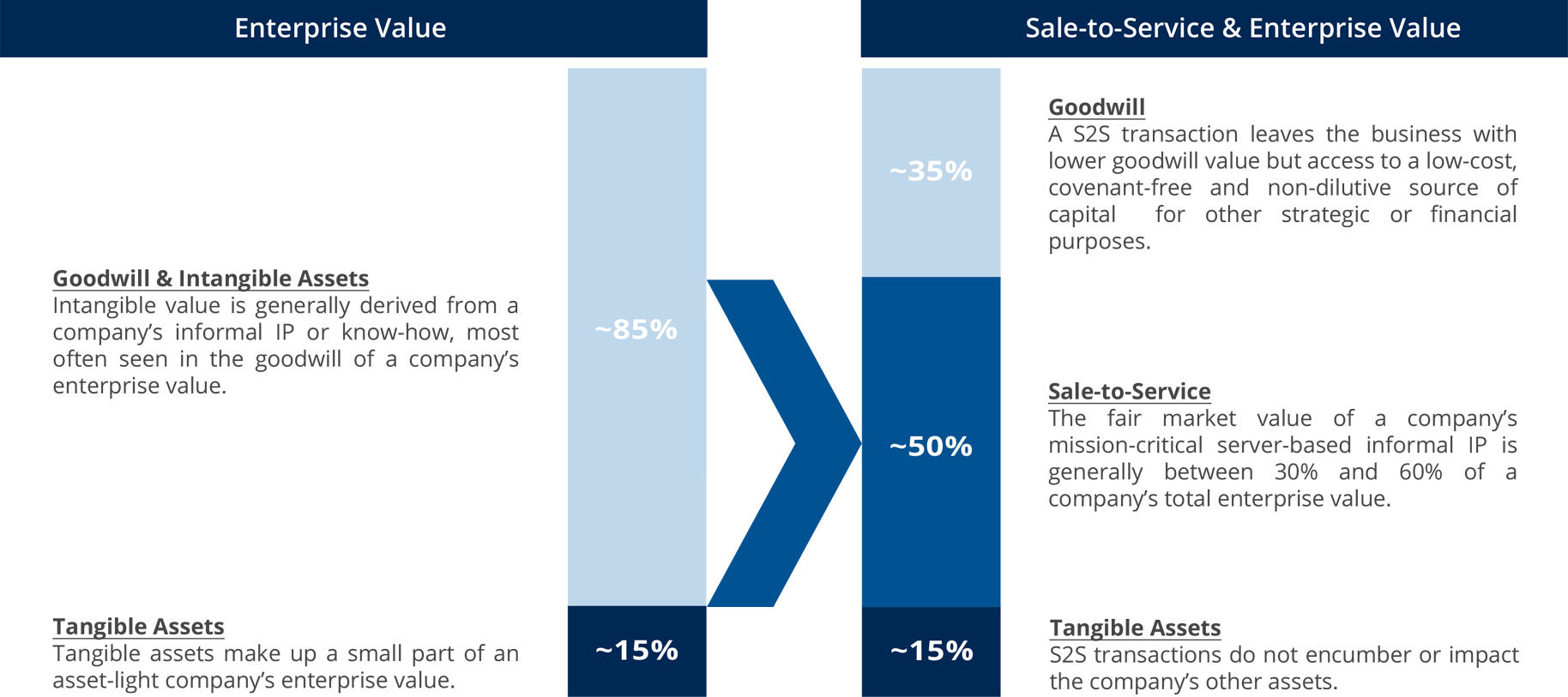

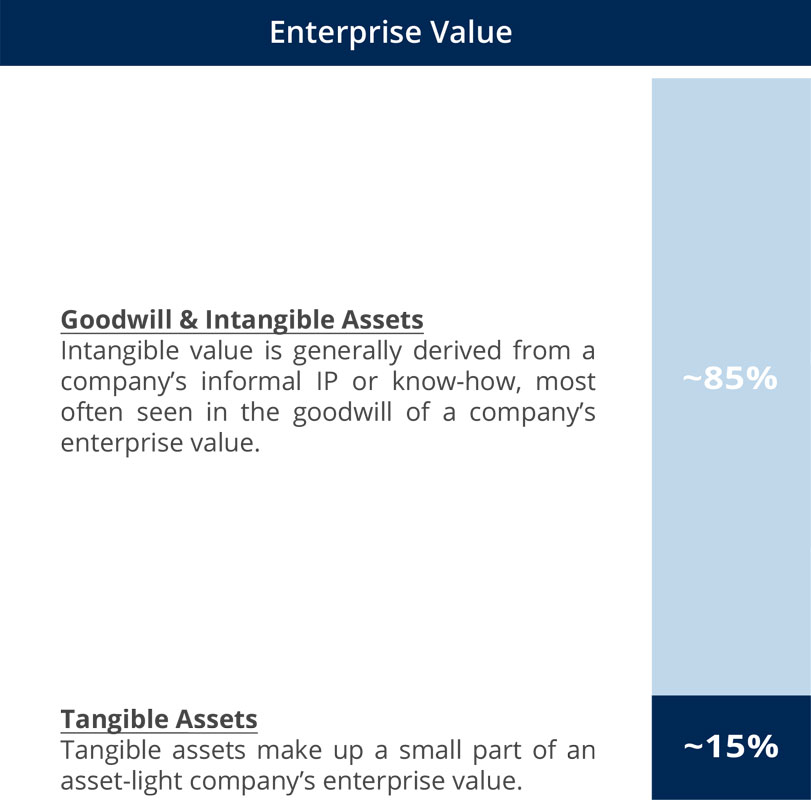

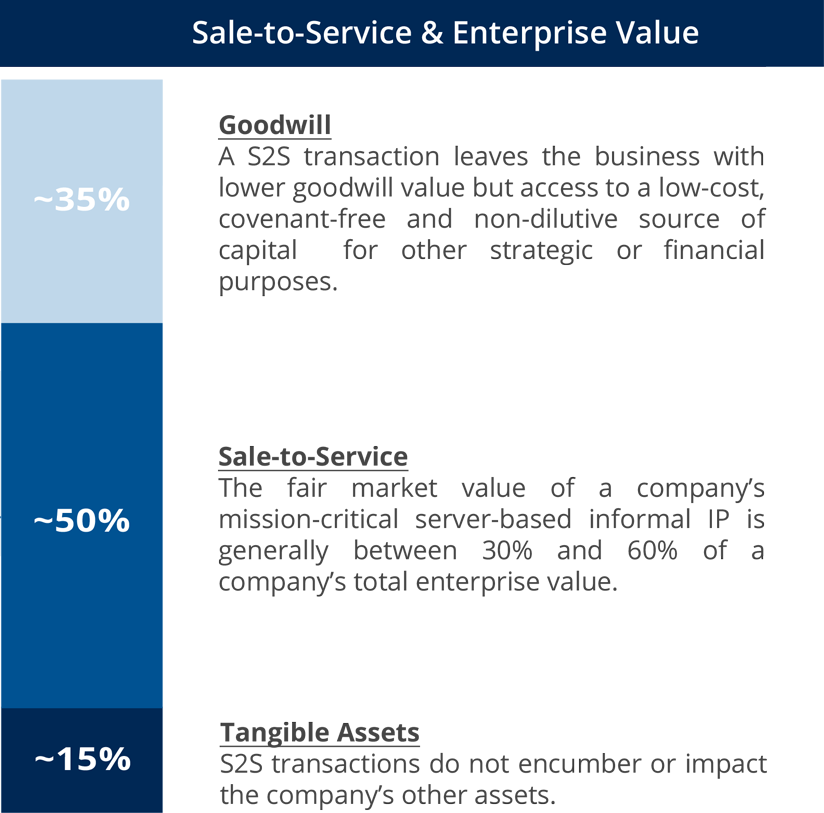

Enterprise Value & Sale-to-Service

Leeward’s Sale-to-Service® (S2S®) unlocks the value of a company’s mission-critical systems and data, server-based assets that have been enhanced and customized over years and are essential to business. These intangible assets have little to no value on a company’s balance sheet but comprise a large part of a company’s enterprise value.

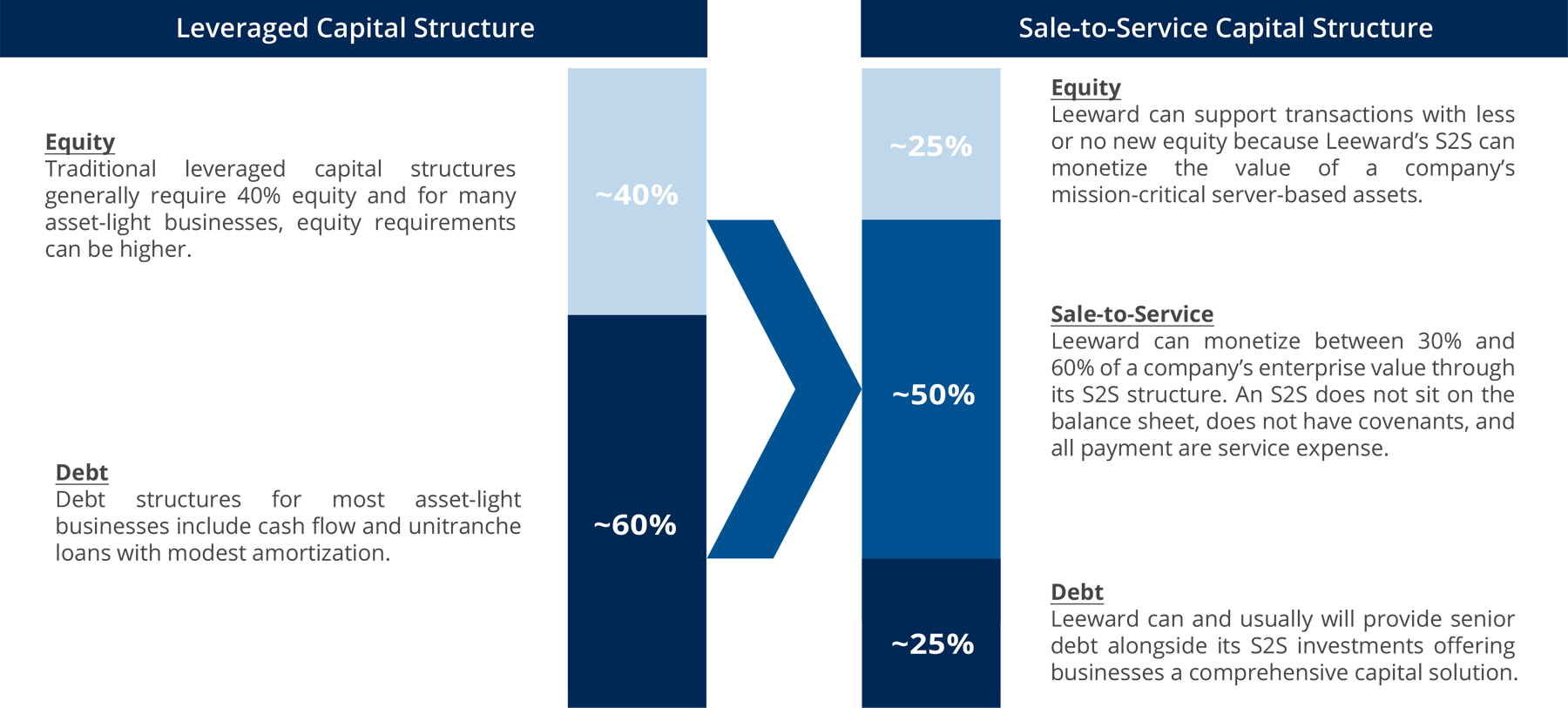

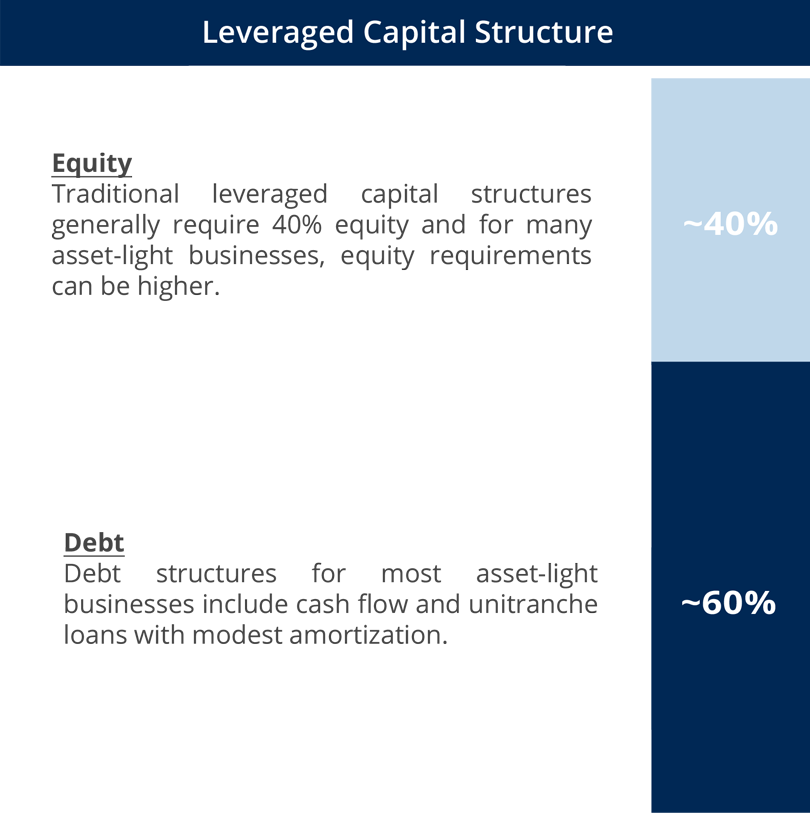

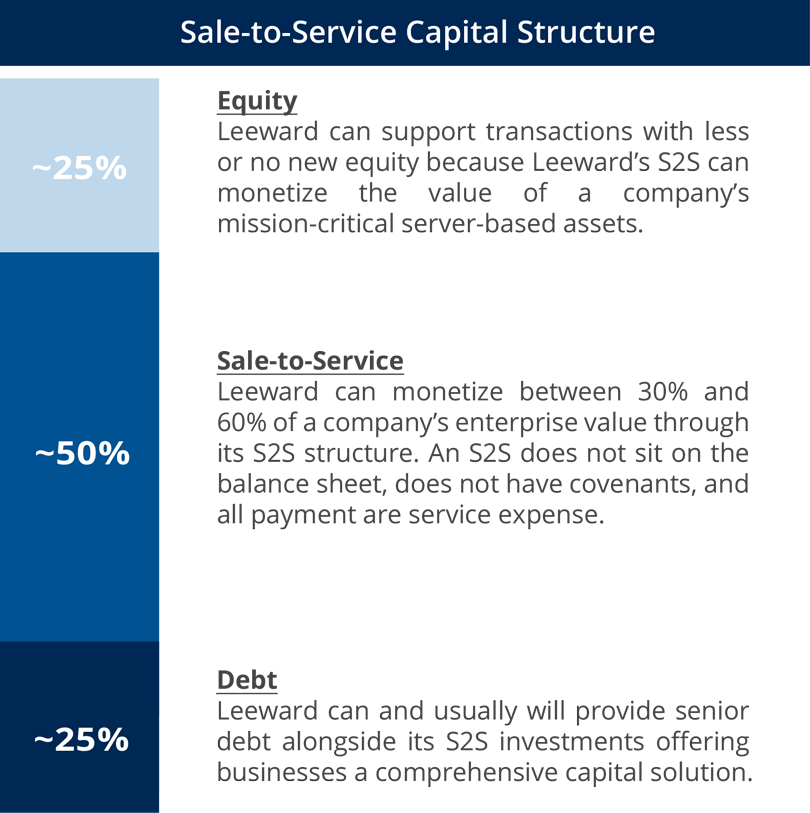

Capital Structure & Sale-to-Service

An S2S® fits into the capital structure as an alternative to mezzanine debt and minority equity. Leeward can also provide senior debt alongside its S2S® offering a comprehensive source of capital for closely-held and related-party transactions.

About Us

Matthew Hagen – Founder & Managing Partner

Matthew is the founder and Managing Partner of Leeward. Matthew’s fifteen-year tenure as the CEO of a large data & technology-enabled logistics business makes him experienced in the intersection of a company’s operations with its technology, systems, and data. Matthew implemented the first S2S® transaction for his family’s logistics business, American Forest Products. Matthew started Leeward to deliver a similar capital solution for other closely held businesses seeking an alternative to equity and higher-cost debt. Matthew received a BA and BS from the University of Southern California and an MBA from Harvard Business School and has been a member of the Young Presidents Organization for over 18 years.

Email: mhagen@leewardcapitalmgt.com

Work: (469) 718-7333

Capital

Leeward has partnered with a select group of family offices, credit funds, and structured equity groups to capitalize its investments. Leeward selects a capital partner for each investment based on the partner’s industry expertise and the size of the investment.