Watch How & When a Sale-to-Service Works

How an S2S Works

When an S2S Works

Sale-to-Service Transaction Structure

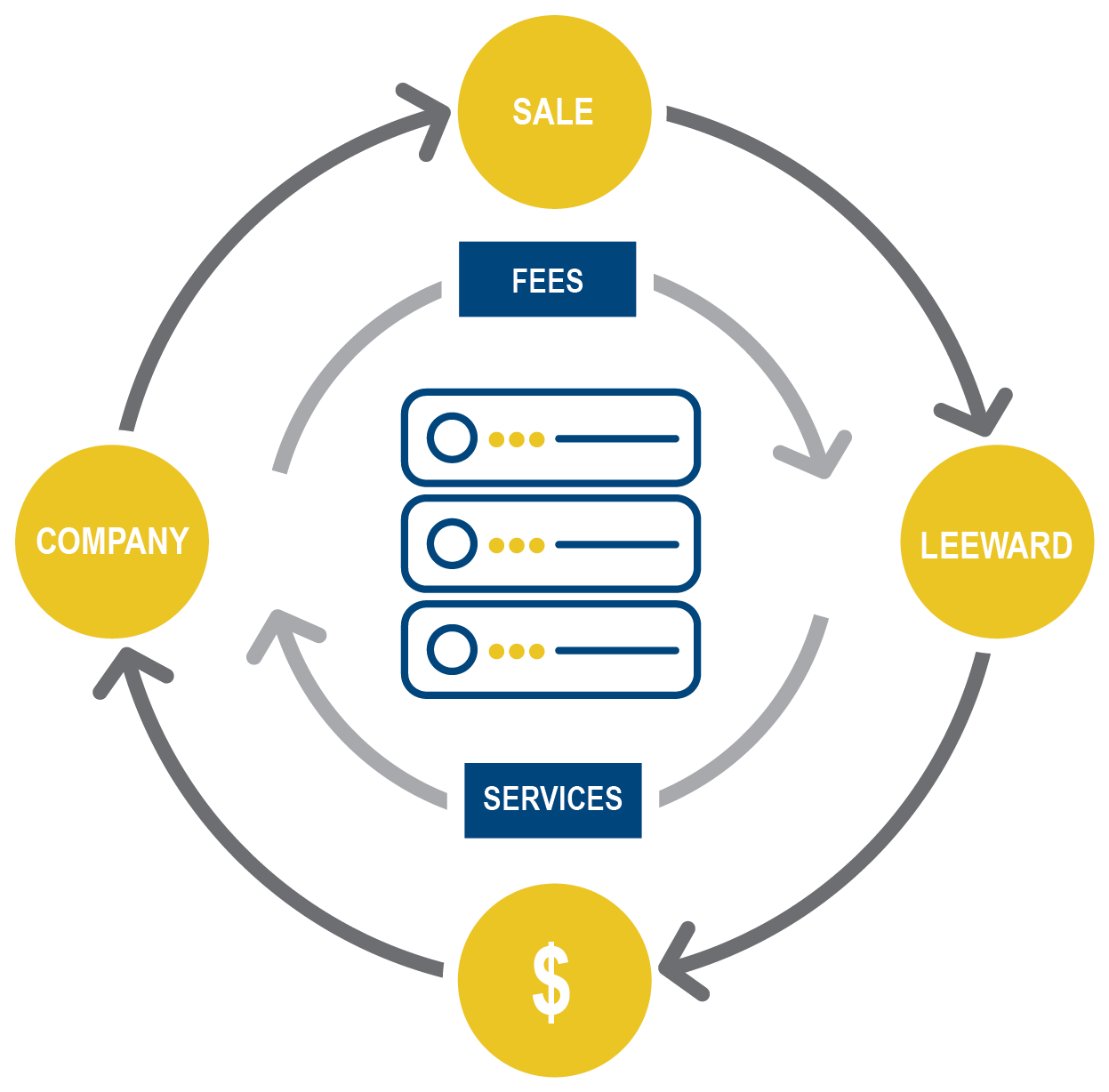

An S2S® is similar to a sale-leaseback but rather than acquiring physical assets like equipment, an S2S® monetizes systems and data assets, server-based intangibles that are mission-critical to the business. Leeward values these assets based on enterprise value rather than book value, value which usually shows up in goodwill in an acquisition.

Rather than a lease or license agreement, an S2S® utilizes a three to six-year services agreement. The S2S® structure does not impact the operations of the business and the company is free to upgrade and enhance the systems as needed.

The company may pay a fee to exit the S2S® early, generally after 24 months. Upon early termination or maturity, the company may then repurchase the assets for fair market value or extend the agreement for up to fifteen years.

Leeward’s patent-pending S2S® delivers a low-cost no-covenant off-balance-sheet alternative to mezzanine debt but behaves like preferred equity.

Capital Comparison

| Attribute | Unitranche / Mezzanine | Sale-to-Service | Equity |

|---|---|---|---|

| Effective Cost | 8% – 15% | 2% – 8% (1) | 20% – 30% |

| Availability of Funds | 2.5x – 5x EBITDA | 2.5x – 5.5x EBITDA | 4x – ~12x EBITDA |

| Covenants | Modest to Strict | No Covenants | None |

| Exit | Sale or Refinance | Maturity or Early Termination | Sale |

| Cash Flow Demands | Modest | Comparable to 1% Per-Month Amortization |

None |

| Board Rights | Various | None | Board Representation |

1) After-tax cost decreases with early termination.

Sale-to-Service Overview

Innovation in the capital markets has not kept pace with the United States’ transition from an asset-intensive manufacturing economy to an asset-light service economy. Leeward’s innovative investment structure is an exception. Learn how Leeward’s Sale-to-Service® identifies and monetizes one of the economy’s most valuable assets.

S2S Overview for Owners & Trusted Advisors

Frequently Asked Questions

S2S candidates have mission-critical systems or data that are essential to the company’s business model. Systems are generally developed internally but can also be traditional enterprise resource systems (SAP, Oracle, etc.) that have been heavily customized. Propriety data is also a fit for Leeward even if the systems are not critical. If the company would be challenged to replace its systems or data over three to four months, then the company is likely a fit for Leeward’s S2S. If the company uses a third-party SaaS system, it is generally not a fit for the S2S.

Intangible value comes generally in two categories, formal intellectual property (“formal IP”) like copyrights, trademarks and patents and informal intellectual property (“informal IP”) which includes a company’s workforce, supplier and customer relationships, technology, processes, and data. These informal IP assets commonly referred to as a company’s know-how, are intangible assets of the business and are most often seen in the goodwill of a company’s enterprise value. Leeward’s S2S investment structure is designed to monetize the informal IP of a business, more specifically the know-how built into a company’s technology and data, which usually sits in a data-center or in the cloud.

The S2S is similar to a commercial real estate sale-leaseback but rather than buying tangible assets like equipment or real estate, Leeward acquires a company’s systems, processes, and data which reside on a server in a data center or in the cloud. The S2S contract has financial similarities to a sale-leaseback but, among other distinctions, the seller gets access to the systems and data as a service and not through physical possession like a traditional sale-leaseback. S2S fees are operating expense to the company and are contingent on service levels.

An S2S agreement is generally between three and six years but can go longer in certain circumstances. The S2S fee has a fixed and variable component allowing fees to adjust based on the company’s performance. All fees are operating expense to the company and contingent on service.

The S2S consumes the same or more cash on a pre-tax basis compared to traditional financing solutions but consumes less cash on an after-tax basis.

S2S customers will pay capital gain tax on the initial sale of the assets and all S2S fees are operating expense.

The customer has the right to terminate the S2S after an agreed upon period, generally two years. The termination fee is predetermined and is an operating expense like the monthly S2S fees.

Upon termination or maturity of the S2S, the customer has the right to repurchase the assets on commercially reasonable terms. The company can also extend the S2S for up to 15 years for a commercially reasonably monthly fee.

S2S customers must value Leeward’s S2S attributes more than the higher pre-tax cash flow offered by modestly amortizing term debt or equity. Leeward’s S2S solution offers non-dilutive, covenant-free capital at an after-tax cost competitive with a senior cash flow loan but in amounts greater than traditional mezzanine or unitranche debt.

An S2S can coexist alongside a third-party asset-based loan but if the transaction requires a cash flow loan, Leeward will generally provide the cash flow facility as well offering the customer a complete capital solution.

Asset-light businesses have a higher probability of being a fit for Leeward’s S2S but there are certain asset-heavy businesses that may also be a fit. Specifically, if the management, tracking or operation of the physical assets rely on the company’s systems or data, then the business is likely a fit.

Leeward’s business evaluation is similar to a traditional credit process and also includes an evaluation of the mission criticality and fair market value of the company’s technology and/or data. Leeward’s technology and data evaluation does not increase the time to close compared to a traditional capital markets transaction.

C-Corporations: The double taxation of C-corporations creates an additional level of tax as C-corps pay capital gains on the sale of the assets and then shareholders have to pay dividend tax on the distributions. Exceptions include C-corporations with large operating losses carryforwards.

SaaS Businesses: If the company’s revenue is based largely on license income, it is not a fit. The S2S does not work for SaaS businesses as the technology and data assets of a SaaS company are the income producing assets of the business. The S2S is a fit only if the company’s technology and data support whatever product or service the company provides, rather than being the product in and of itself. Example: An online lead generation business that earns revenue from the sale of leads is a fit but if the company is licensing its lead generation technology to its customers, it is not a fit.

Distressed: Turn-arounds and restructurings are not a fit.

Pure Debt Recapitalization: If proceeds are used to exclusively payoff existing debt, the S2S will not generally be a fit unless the company or its shareholders have net operating loss carryforwards.

An Introduction to Intangible Assets & Intangible Asset Finance

The world has moved from an industrial economy reliant on physical assets to a service economy reliant on intangible assets. This presentation provides an overview of intangible assets, ways to finance them and ways to maximize them to drive shareholder value.